RapidLEI recently announced our partnership with UK-based FinTech, Ceviant. The partnership enables Legal Entity Identifier (LEI) issuance to be built into the Ceviant treasury platform. To kick off the partnership, a webinar was on the application of Legal Entity Identifiers (LEIs) was held with Nathan Tourret of RapidLEI, Benjamin Würzburger and Dennis O’Brien of Ceviant. Watch webinar to learn more around LEIs and the RapidLEI, Ceviant partnership.

Webinar | Legal Entity Identifiers: Key Application in AML & other areas with RapidLEI and Ceviant

What you will learn in this webinar

- The history of LEIs

- What is the LEI?

- What is happening in the current LEI ecosystem?

- What problems are been realised so far?

- What we are doing, to push the LEI ecosystem forward

Found this webinar useful? Discover our key takeaways below:

History of Legal Entity Identifiers

History of Legal Entity Identifiers Timeline

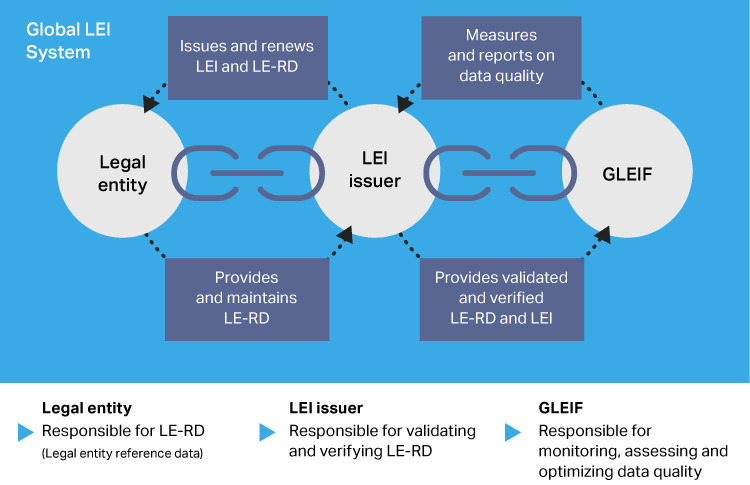

The structure of LEI issuers and issuance starts with Local Operating Units (LOUs). LOUs then work in partnership with Registration Agents (RAs), and Validation Agents (VAs) to provide local support and issuance of LEIs.

To find out more about the history of LEIs, take a listen to the Let’s Talk About Digital Identity podcast episode, LEI and the History of Identities for Businesses. Clare Rowley from the GLEIF joined this special episode to discuss LEIs from conception through to the current ecosystem.

What is an LEI?

The LEI is a 20-digit alphanumeric code, which can be broken down into three sections. Example of LEI code and breakdown below:

Current LEI Ecosystem

- The LEI database captures the structure of an organisation, making it a one-stop-shop to understand who you’re dealing with, who owns the company, the legal entity, and where the entities are registered.

- The LEI is the only globally standardised entity identifier.

- There are now 294+ global compliance and regulations requiring use of an LEI, including in Australia, India and Europe.

- LEI adoption has increased significantly over the past 6-8 months. Largely due to the use of LEIs in AML, KYC, risk management and client onboarding.

What problems have been realised so far?

Robust business credentials are a major obstacle, particularly for SMEs in developing economies, the LEI provides organisations of all sizes a way to identify themselves, in a highly assured way.

The use of LEIs provides transparency leading to, financial stability, reporting, easier compliance and regulations, better risk management, less friction, and better decisions.

There are various benefits to banks and organisations, for using LEIs, especially for onboarding and compliance services, for example improved customer experience.

Banks and financial institutions are increasingly getting involved with LEI issuance and management, by becoming Validation Agents.

The LEI has seen increased adoption outside of traditional financial markets, for example, the US Customs and Border Force trialling the LEI as a global identifier for import and export.

There are major cost savings bought by LEI adoption and investment. The McKinsey Company found; the use of LEIs in certain banking environments could annually save the global banking system, 2-4 billion in client onboarding.

What are we doing to push forward the LEI ecosystem?

The RapidLEI and Ceviant partnership aims to improve access to trade finance and partnerships, especially for SMEs.

Verifiable LEI (vLEI) is the next step of the ecosystem, creating the ability to validate individuals, organisations, and Official Organisational Roles, confirming they are able to act on behalf of the organisation.

The LEI is not a compliance requirement alone, rather it is a highly assured organisation identity. Providing a way for organisations to identify themselves globally, while also improving robust and streamlined processes for governance, authentication, authorisation, and delegation.

Legal Entity Identifier Webinar Q&A

The Q&A session at the end of the webinar provided further insight, based on questions of those in attendance.

-

-

-

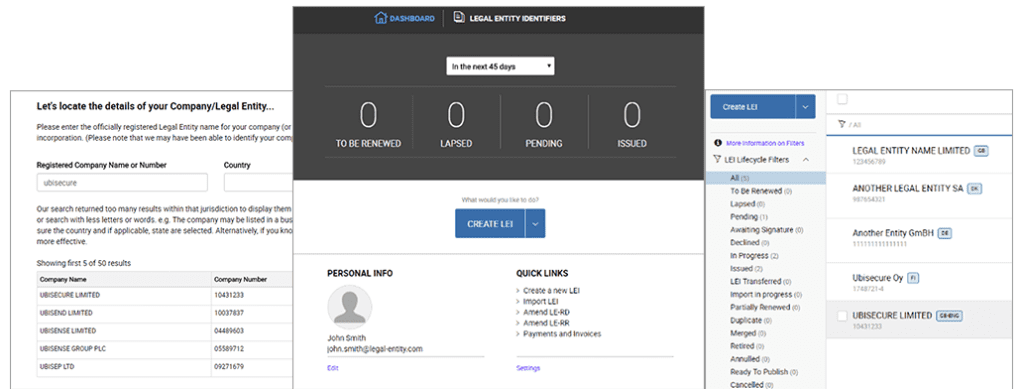

- What is the process to get an LEI?

- What documentation is needed?

- The LEI application process

- How long does LEI issuance take?

- How do the RapidLEI APIs improve LEI issuance?

- When an LEI is present in KYC and onboarding, is other documentation required?

- What are the main value benefits of having an LEI?

- What is the process to get an LEI?

-

-

This webinar provides valuable insights into the importance and benefits of LEIs in various areas. To found out more about LEIs, RapidLEI, and our partnership with Ceviant, watch the webinar or get in touch with any questions.

About The Author: Chloe Hartup

More posts by Chloe Hartup