Regulatory Use of the LEI > China

LEI regulations in China

The People’s Bank of China (PBOC) published a roadmap for the implementation of LEIs in China from 2020 to 2022, by which point LEIs will be required for securities and derivatives trading, risk monitoring, regulatory reporting, listed company supervision and the digital yuan ecosystem.

What is China’s PBOC roadmap?

A roadmap for China’s implementation of LEIs was jointly released in 2020 by the People’s Bank of China (PBOC), China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission and State Administration of Foreign Exchange.

It outlines key milestones for the implementation of LEIs in China from 2020 to 2022 as part of the ‘Belt and Road Initiative’ initiative, and will require LEI usage to bring China’s financial system in line with international standards.

What’s in China’s LEI roadmap?

The milestones include:

- By the end of 2020, at 30,000 Chinese entities will have LEIs, including financial institutions, financial infrastructures, member institutions of industry associations, and listed companies. ✔️ (At the end of 2020, there were 37,000 active LEIs from Chinese entities.)

- By the end of 2021, at least 50,000 Chinese entities will have LEIs, including importers and exporters, trading companies and non-financial enterprises participating in cross-border transactions.

- By the end of 2022, at least 100,000 Chinese entities will have LEIs, increasing coverage of non-financial companies participating in cross-border transactions.

2020

LEI volume up to 30,000:

- All financial institutions

- Member institutions of financial infrastructure and industry associations

- Listed companies in China

Proposed applications for e.g.:

- RMB cross-border payments

- Digital RMB cross-border business

- Qualified foreign institutional investor (QFII) and RMB qualified foreign institutional investor (RQFII) access

- Derivatives trading

- Securities trading

- Listed company supervision

Institute a mechanism for:

- Mapping and updating LEI with the codes of financial institutions

- Unified social credit codes

- Codes of information systems related to major financial infrastructure

2021

LEI volume up to 50,000:

- More coverage among importers and exporters

- Trading enterprises

- Non-financial enterprises involved in cross-border transactions

Proposed applications for e.g.:

- The financial market transaction reporting system

- Credit rating

- Application of special institutional codes by overseas institutions.

Launch and operate:

- Cross-border legal person information service and digital authentication platform to provide value-added LEI-based data services to financial management departments, financial infrastructure, financial industry associations and financial institutions

2022

LEI volume up to 100,000:

- Still more non-financial enterprises involved in cross-border transactions

Proposed applications for e.g.:

- Digital identification of cross-border legal persons.

Institute a mechanism for:

- A commercially sustainable LEI operation.

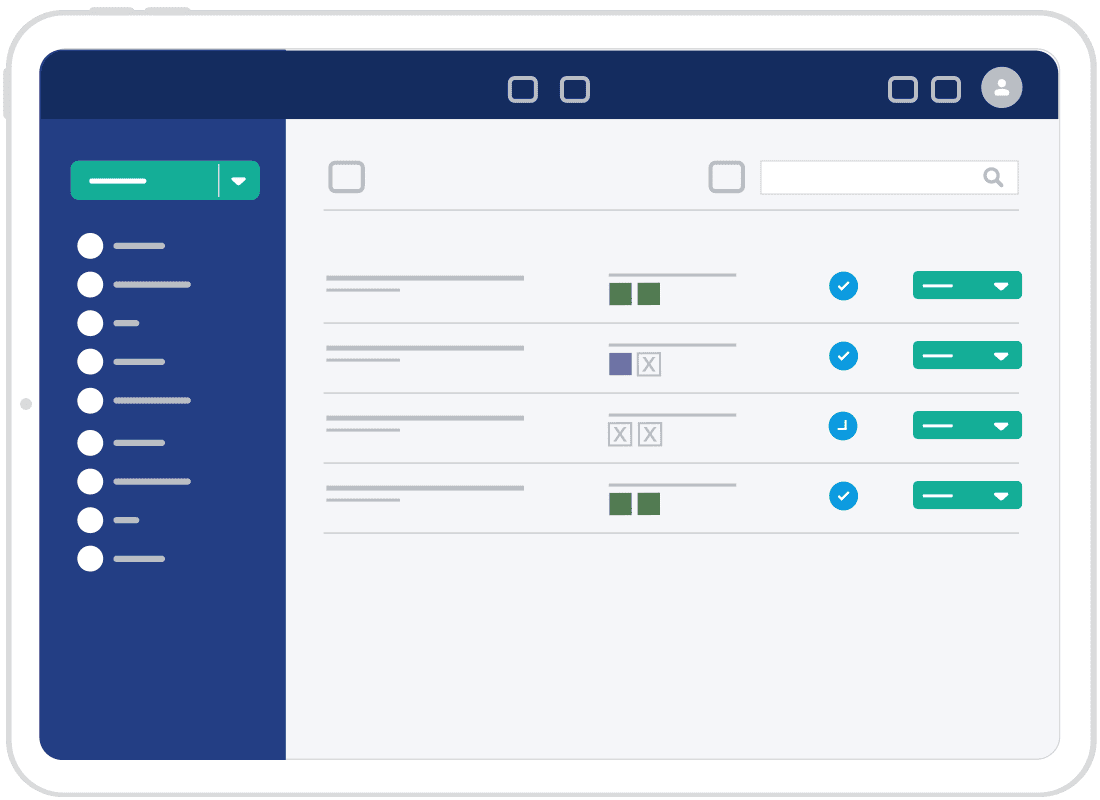

2020 |

2021 |

2022 |

|

| LEI volume | 30,000 | 50,000 | 100,000 |

| Entities requiring LEIs | All financial institutions

Member institutions of financial infrastructure and industry associations Listed companies in China

|

More coverage among importers and exporters

Trading enterprises Non-financial enterprises involved in cross-border transactions

|

Still more non-financial enterprises involved in cross-border transactions

|

| Proposed application examples | RMB cross-border payments

Digital RMB cross-border business Qualified foreign institutional investor (QFII) and RMB qualified foreign institutional investor (RQFII) access Derivatives trading Securities trading Listed company supervision

|

The financial market transaction reporting system

Credit rating Application of special institutional codes by overseas institutions.

|

Digital identification of cross-border legal persons.

|

| Institute a mechanism for | Mapping and updating LEI with the codes of financial institutions

Unified social credit codes Codes of information systems related to major financial infrastructure

|

Cross-border legal person information service and digital authentication platform to provide value-added LEI-based data services to financial management departments, financial infrastructure, financial industry associations and financial institutions

|

A commercially sustainable LEI operation.

|

China’s LEI regulations

| Jurisdiction | Rule | Master/Base Regulation | Effective Date | Required vs. Requested | Status | Link |

| China | Order of the People’s Bank of China (No. 3 [2017] The Measures for the Registration of Pledged receivables as amended and issued by the People’s Bank of China | 2017 | Requested | Approved | Link | |

| China | General administration of customs notice no. 56 of 2017 | 2018 | Requested | Approved | ||

| China | Notice on Provision of Legal Entity Identifiers by Institutional Investors Registering to Enter Inter-Bank Bond Market | 2019 | Requested | Approved | ||

| China | Interbank Market Metadata (JR/T 0065-2019) and Interbank Market Information Exchange Protocol (JR/T 0066.1-2019) | 2019 | Requested | Approved | Link | |

| China | Statistics System of External Financial Asset/Liability and Trading | 2019 | Requested | Approved | Link | |

| China | Guideline on Operation of Securities Accounts | Guideline on Operation of Securities Accounts | 2018 | Requested | Approved | Link |

| China | Notice on Reporting of Legal Entity Identifiers by Bond Issuers | Notice on Reporting of Legal Entity Identifiers by Bond Issuers | 2019 | Requested | Approved | Link |

| China | Order No. 5[2019] of the People’s Bank of China, the National Development and Reform Commission, the Ministry of Finance and the China Securities Regulatory Commission | Interim Measures for the Administration of Credit Rating Industry | 2019 | Required | Approved | Link |

For global LEI regulations, visit Regulatory Use of the LEI.

Obtaining LEI Codes in China

With RapidLEI, Chinese entities can discover, verify, renew, and manage client LEI codes at scale. This can be done ad-hoc as needed, or more holistically by integrating LEI registration into customer onboarding services.

RapidLEI makes obtaining, registering and renewing Legal Entity Identifiers faster, simpler and more cost effective. Our automated systems register and renew LEIs in minutes, and our Management Platform makes managing multiple LEIs effortless.

As a GLEIF accredited LOU, we offer the only LEI issuance API that supports the discovery, registration, management, and renewal of client LEIs. The API is available to both Registration Agents and Validation Agents.