Organisations register Legal Entity Identifiers (LEI) for a diverse set of reasons. The introduction of new LEI use-cases and regulatory requirements have resulted in almost 1.7m organisations using LEIs. However, with hundreds of millions of organisations worldwide yet to register an LEI, the current LEI universe is just the tip of the iceberg.

To drive LEI adoption to 2.0 levels (e.g. 20m+ LEIs), the Global LEI Foundation (GLEIF) has introduced the Validation Agent (VA) framework to expand the registration of LEIs well beyond regulatory requirements. The framework is directed at Banks, Financial Institutions (FI), and Trust Service Providers who currently perform duplicative processes when onboarding new business customers and then separately registering (or requiring the organisation to register) an LEI. Multiple workflows are inefficient and completion delays can be frustrating to all parties.

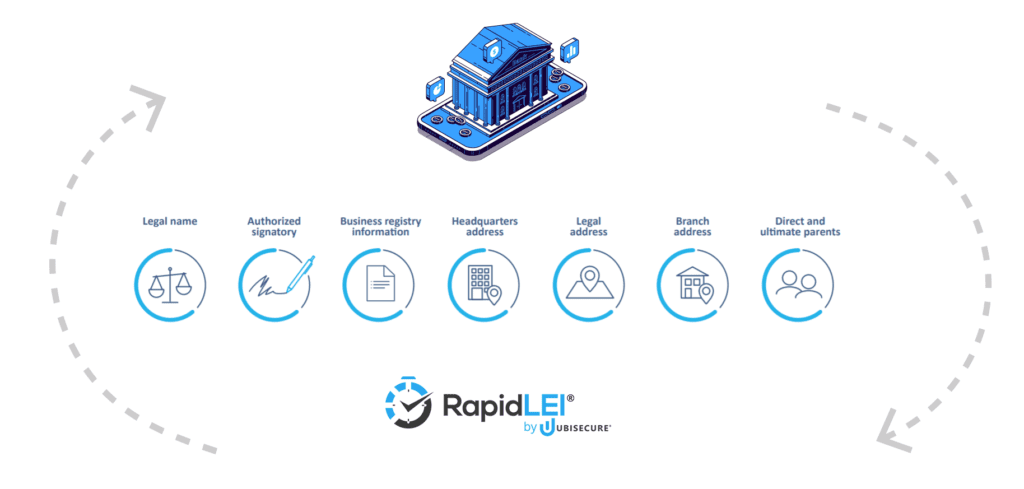

Consolidating the onboarding and LEI registration processes into one streamlined workflow removes the workload repetition and can eliminate the frustrations experienced by both the FI and their clients.

By simplifying and accelerating the LEI issuance process, the new Framework also paves the way for FIs to expand their usage of the LEI beyond capital markets to encompass all banking business lines, an opportunity anticipated to save the industry U.S.$2-4 billion annually in client onboarding costs alone.

GLEIF – LEI VA Framework eBook

Validation Agent support via the RapidLEI platform & API

RapidLEI is an accredited LEI Issuer (LOU). Our goals have always been to streamline LEI issuance and enhance legal entity data quality. Throughout 2020, RapidLEI has achieved number 1 positions for LEI issuance and entity data quality. We believe we are well on track to now achieving those goals at a much larger scale.

We believe the GLEIF’s VA concept is in line with our mission, and we’re proud to be one of the first LOU to announce platform and API support for the new framework.

The RapidLEI platform and API can be integrated into existing KYC and AML workflows to automate both the validation of legal entity validation data and the subsequent registration of the LEI with the Global LEI System (GLEIS).

Thanks to the platform’s automation technology and pre-integration into many local business registries, RapidLEI offers a unique approach to the Validation Agent framework. By using RapidLEI as their VA solution, FIs gain both validation enhancements to the legal entity data they are using, and the assurance that only accurate LEIs meeting GLEIS data quality requirements are registered. It’s a win-win situation – enhanced legal entity data quality supporting existing onboarding requirements and the synchronous registration of LEIs.

For the benefit of the ecosystem in general, RapidLEI VAs can both expand the number of organisations using LEIs and enhance the overall reliability of KYC data registered with the GLEIS. This further drives non-regulatory use cases (such as those highlighted in the LEI Marketplace).

Next steps – registering as a VA

Learn more about becoming a Validation Agent.

Contact RapidLEI or a Certified RapidLEI partner in your jurisdiction to discuss how your organisation could become a VA. We are working very closely with the GLEIF on enabling early VA pilots as a participating LOU, and welcome stakeholder feedback.

About The Author: Steve Waite

Steve is the Chief Marketing Officer for Ubisecure and RapidLEI.

More posts by Steve Waite