DID, GLN, DUNS, BIC, TIN, and LEI

Organization identifiers are essential tools in the modern business world where B2B value is high and trading across borders and supply chain management is complex. Such organization identifiers help streamline transactions, communication, trust, and collaboration between different parties by identifying and connecting the parties involved.

This blog post will provide an overview of six common organization identifiers: Decentralized Identifier (DID), Global Location Number (GLN), Data Universal Numbering System (DUNS), Bank Identifier Code (BIC), Taxpayer Identification Number (TIN), and Legal Entity Identifier (LEI). We will also look briefly at their respective real-world use cases.

All these identifiers, except DUNS, are identified in the World Trade Organization’s Standards Toolkit for Cross-border Paperless Trade.

Decentralized Identifier (DID)

DID is a framework and container for identity, but not an identity scheme. DIDs are often used in conjunction with distributed ledger technology, such as blockchain. It allows individuals, organizations, and things to be identified and connected without the need for a centralized authority, and enables privacy protecting systems.

Real-World Use Case: DID can be used to store or reference verifiable digital identities for people, organizations, and devices, enabling secure and private communication, transactions, and authentication in various industries, including finance, healthcare, and supply chain management.

Global Location Number (GLN)

GLN is a proprietary 13-digit unique identifier developed by GS1. GLN allow organizations to identify physical locations, legal entities, or functions within their organization. The identification data is supplied by the entity.

Real-World Use Case: GLN is used to manage and track the flow of goods and services in the supply chain, from manufacturers to distributors to retailers.

Data Universal Numbering System (DUNS)

DUNS is a proprietary nine-digit identifier assigned and managed by privately owned Dun & Bradstreet (D&B). The DUNS number is used to identify businesses, primarily being used to provide a method for tracking and assessing the creditworthiness and financial health of organizations. Once considered the “standard” for organization identification, as of April 2022 the DUNS ceased being used by the US federal Government.

Real-World Use Case: DUNS numbers are commonly used by businesses and governments to evaluate potential suppliers, partners, and customers. They help organizations make informed decisions about credit risk, procurement, and market research.

Bank Identifier Code (BIC)

BIC, also known as the SWIFT code, is an entity-supplied alphanumeric code that uniquely identifies financial institutions and sub-elements within the organisation. It is used for international wire transfers and messages between banks, ensuring accurate routing of transactions.

Real-World Use Case: BIC is crucial for cross-border transactions, such as international wire transfers, securities trades, and foreign exchange transactions.

Trader Identification Number (TIN)

Trader Identification Number (TIN) is a unique identifier assigned to Authorized Economic Operators. An Authorized Economic Operator (AEO) is a party involved in the international movement of goods that has been certified by a national Customs administration. TINs are assigned by national bodies, typically governmental, for the purposes of customs processing of import and exports. TINs are not publicly available or referenceable.

See: WCO Guidelines on Trader Identification Number

Real-World Use Case: TINs are used by importers to enhance the data quality of Customs clearance processes, improve the visibility and transparency of supply chains, and enable Customs to enhance supply chain security.

Legal Entity Identifier (LEI)

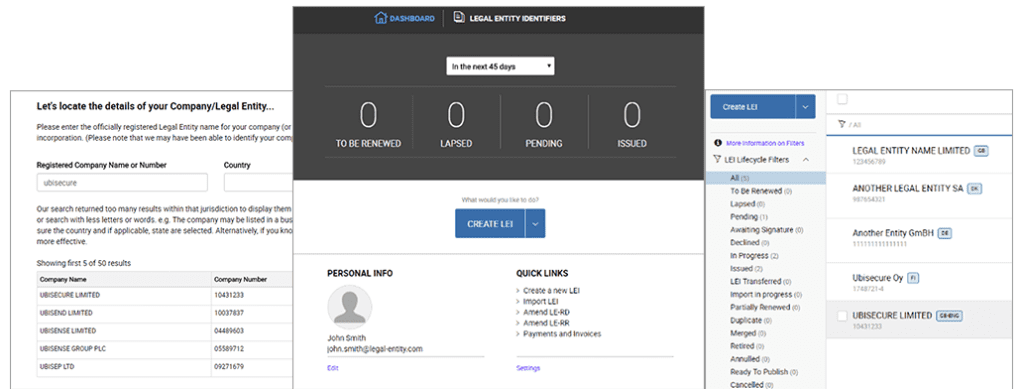

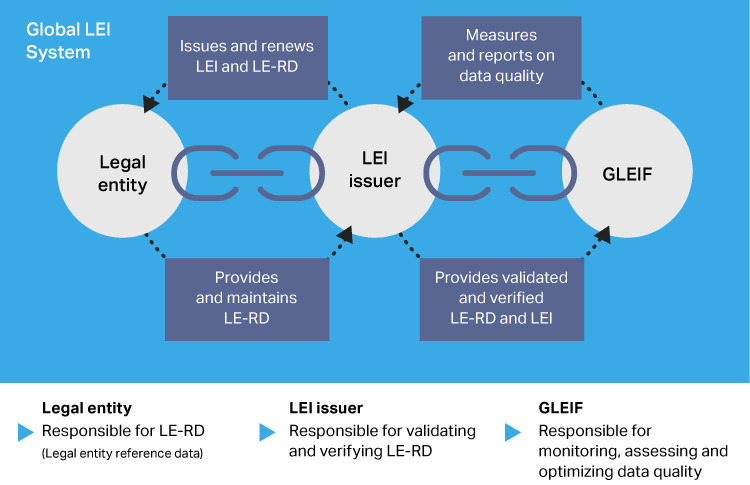

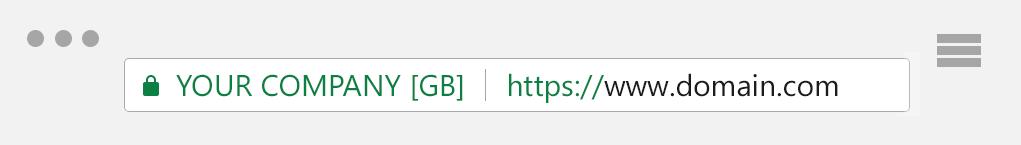

LEI is a 20-character alphanumeric code that uniquely identifies legal entities and group structures in a live, publicly accessible database. It was introduced by the supra-national not-for-profit Global Legal Entity Identifier Foundation (GLEIF) under the direction of the G20 and Financial Stability Board (FSB) as a single identifier to enhance transparency of “who is who” and “who owns whom”, to identify counterparties and reduce risk in transactions. Over 300 regulations require or recommend the use of LEI. LEIs are only issued by GLEIF-accredited LEI Issuers.

Real-World Use Case: LEI is used to identify parties involved in financial transactions, including banks, investment firms, and corporations. It helps regulators monitor systemic risks, reduce financial fraud, and increase transparency in financial markets. More recently the LEI has been incorporated into innovative new use cases including entity data management, digital signing, B2B Identity & Access Management and others.

Conclusion – the case for the LEI

Organization identifiers evolved for jurisdictional or vertical markets, historically leading to an over-complex and confusing choice for businesses. The LEI is designed to simplify the concept of organization identity by providing both accessible identity reference data, and acting as a “connector” to other specific-purpose identifiers. For example, a partnership between the GLEIF and SWIFT to publish BIC-to-LEI mapping demonstrates the flexibility of the LEI to co-exist alongside legacy identifiers, to simplify otherwise costly entity data management processes.

The one global identity behind every business.

LEI is the linchpin that connects the dots across the universe of entity identification.

Global LEI Foundation

Global trade needs a standardized organization identifier, and fortunately the LEI is well on the way to making the case to be what the GLEIF calls the one.

Read more:

About The Author: Steve Waite

Steve is the Chief Marketing Officer for Ubisecure and RapidLEI.

More posts by Steve Waite