The Legal Entity Identifier (LEI) is a unique alphanumeric code for legal entities, funds and trusts participating in commercial, trade, or general financial transactions. It enables identification across a wide range of financial applications and has the potential to play a significant role in the modern financial system by enabling counterparty bona fides verification. This verification is essential for the know-your-customer/know-your-business (KYC/KYB) processes required in traditional and modernized financial services activities.

Amit Sharma is the Founder and CEO of FinClusive, a global Compliance-as-a-Service (CaaS) infrastructure provider that enables increased compliant and equitable financial engagement by facilitating traditional banking’s connectivity with emerging technology networks, existing and alternative payment rails, and financial services providers. FinClusive’s CaaS is a globally orchestrated anti-money laundering/financial crimes compliance toolkit with modernized KYC/KYB- backed digital identity credentialing and LEI issuance and validation.

Amit Sharma is the Founder and CEO of FinClusive, a global Compliance-as-a-Service (CaaS) infrastructure provider that enables increased compliant and equitable financial engagement by facilitating traditional banking’s connectivity with emerging technology networks, existing and alternative payment rails, and financial services providers. FinClusive’s CaaS is a globally orchestrated anti-money laundering/financial crimes compliance toolkit with modernized KYC/KYB- backed digital identity credentialing and LEI issuance and validation.

How are Legal Entity Identifiers (LEIs) transforming businesses—and emerging markets in particular? What requirements does the LEI meet?

As both traditional and non-traditional financial markets incorporate cross-border transactions, there is a significant need for a uniform identifier across jurisdictions that is precise, digitally verifiable, and interoperable across global regulated financial services providers. The hurdles for verifying identities across the world has resulted in financial fraud, crises, and other abuses, which has become even more complex in the virtual assets space, internet-native financial services applications (web3), and decentralized financial services (DeFi). The LEI has both the necessary infrastructure and simplicity for ubiquitous application across bank and non-bank transactions for businesses around the world.

What are the challenges with know-your-business (KYB) and legal entity verification more broadly? How do we enable businesses to interact seamlessly, transparently, and compliantly in a cross-border world with next generation banking and payments needs?

The biggest challenges for KYB across the industry arise from inconsistent regulatory requirements for identification and compliance across jurisdictions, coupled with the disparate nature in which corporate identities are issued, validated, stored, and accessed. In these cases, entities involved in cross-border transactions often lack the ability to verify that their counterparty is legitimate, non-fraudulent, and not posing a significant business risk. Adding processes like Legal Entity Identifiers (LEIs) goes a long way in addressing these concerns by systemizing the issuance and validation of legal entities, and further, enabling them to verify each other while ensuring adherence to global financial crimes compliance practices and requirements. Broader compliance solutions that are purpose-built for know-your-customer/know-your-business (KYC/KYB) application, including FinClusive’s full-stack compliance-as-a-service (CaaS) platform, are another way that businesses can take security and compliance into their own hands, while enabling near real-time verification and coverage of essential business/entity verification—including the validation of an entity’s beneficial owners.

How are these changes going to happen? Who is driving the changes?

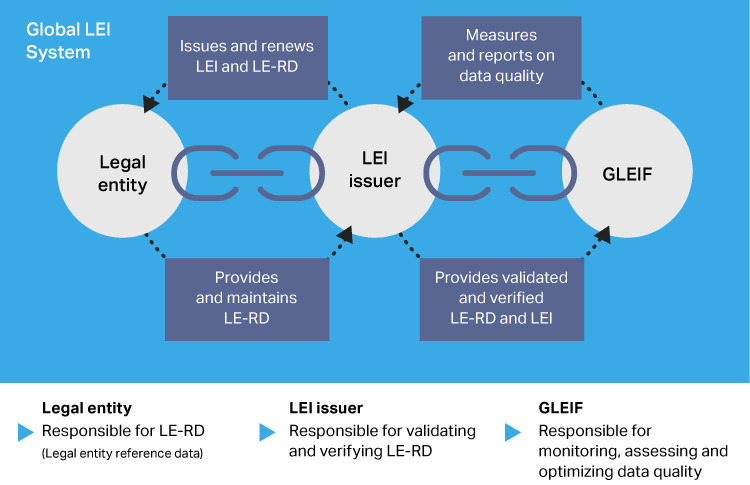

While the best outcomes are reached collaboratively between the public and private sectors, it is important that industry-focused solutions are carefully considered by lawmakers when debating how to regulate the rapidly evolving financial services industry, including and especially those engaged in cross-border payments and virtual assets. As such, industry associations like Global Legal Entity Identifier Foundation (GLEIF) and companies like FinClusive can work hand-in-hand with government actors to guide policy in order to achieve the safest and most effective results for customers. This collaboration enables efficient due diligence, verification of identity, and applications across multiple jurisdictions, financial services operations, and increasingly between counterparties directly (peer-to-peer/business-to-business).

What timescales are we working towards with adoption and resulting benefits for the areas we’ve discussed? What are some examples of low hanging fruit (use cases)?

Legal Entity Identifiers (LEIs) have a wide range of use cases, some of which can be actualized more quickly than others. FinClusive already uses LEIs in know-your-customer/know-your-business (KYC/KYB) use cases, allowing organizations to gather key information about a client or counterparty before entering a transaction and conduct the requisite verification of legal entities wherever located. LEIs can also reduce error and friction for banks, creditors, invoicing, and a wide range of other business relationships. For example, organizations often have minor variations in names used across different official platforms, leading to significant confusion when trying to track the financial history of an entity or ensure adherence to global sanctions requirements and individual jurisdiction-based know-your-business and monitoring requirements.

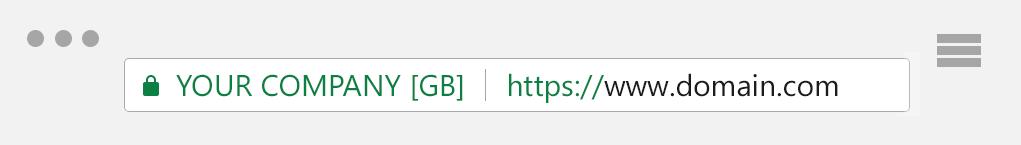

A uniform LEI makes KYC/KYB exercises significantly smoother for all parties. The removal of these hurdles also allows for faster engagement between counterparties and financial transactions around the world. G7 and G20 countries have increasingly looked to LEIs as a strong way to bring global consistency and efficiency to legal entity verification and validation. Coupled with FinClusive’s global KYC/KYB, due diligence, monitoring, and digitally verifiable identity credentials, entities can ensure requisite background checks that mitigate identity fraud, and enable engagement between trading/financial counterparties—and their financial intermediaries—seamlessly and securely, while bringing needed efficiencies to their financial transactions.

How do we drive further adoption and enablement at scale?

Adoption at the international level must come from a coordinated government and private sector approach. FinClusive is one of several organizations globally offering Legal Entity Identifier (LEI) services, but there are only a few based in the United States. Additionally, regulatory mandates are yet to be made requirements—although financial services regulators around the globe are increasingly indicating their importance and use. Building broader infrastructure for LEI adoption around the world and coordinating with federal policy is crucial for widespread use. Enabling multiple financial services providers with LEIs alongside the essential monitoring and other controls to combat fraud and illicit finance, will advance know-your-customer/know-your-business (KYC/KYB) modernization, especially as alternative accounts and payments products and services continue to proliferate in the market.

What potential does the Legal Entity Identifier (LEI) have for global financial inclusion?

Reliable, easily accessible identification has the potential to transform businesses in developing markets. LEIs give trading partners and their financial institutions a new way to interact with unprecedented efficiency and is expected to have immeasurable benefits for global trade and business-to-business (B2B) money flows in the developing world. Small businesses, entrepreneurs, non-profits, development organizations, global corporations, and even alternative financial services providers themselves can seek out and receive a fully credentialed LEI through FinClusive or another provider, enabling them to engage meaningfully in the global economy with legitimacy and transparency.

With more than 99% of global growth stemming from small and medium enterprises (including micro enterprises and commercial entities of all types—corporate, LLC, non-profit/public benefit, and others), LEIs can enable seamless engagement and verification alongside financial system controls that can benefit those enterprises struggling to access or maintain their financial services.

Why is FinClusive working with Legal Entity Identifiers (LEIs)? How does the LEI fit into your services?

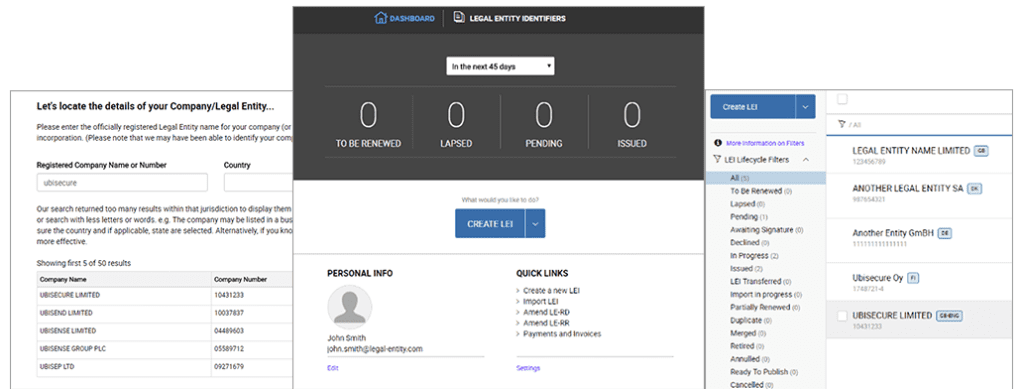

Thanks to our partnership with Ubisecure, FinClusive is one of the only United States-based GLEIF Validation Agents. This allows us to streamline validation of legal entity data and really speed up the registration of LEIs. We are also the only nonbank/non-financial institution to do this. We have integrated the LEI and our proprietary Customer Due Diligence (CDD) Check utility into one platform for our clients, allowing our customers to confirm their partners’ identity, beneficial owners, know-your-business risk, and financial crimes compliance status in one tool. LEI on its own can lack due diligence and jurisdiction validation, both of which FinClusive can cover by integrating LEIs with our FinCID solution. Integrating anti-money launder controls, know-your-business capabilities, and compliance into our full-stack platform allows us to maximize our global orchestration of providers and analytics partners, as well as the reliability and efficiency of cross-border payments and business relationships, thereby advancing financial inclusion of businesses around the world.

Visit www.finclusive.com to find out more about FinClusive and our services.

About The Author: Francesca Hobson

As Content Marketing Manager, Francesca drives content and related marketing activities at Ubisecure and RapidLEI.

More posts by Francesca Hobson